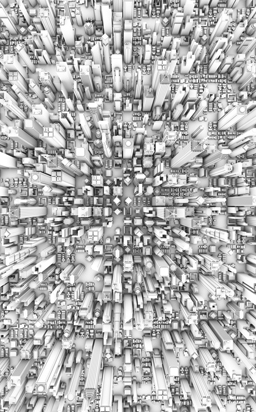

XYverify technology can be added to any Internet transaction session—a browser checkout, card swipe at the point-of-sale (POS), SMS/text messages, active mobile calls or mobile web pages—to detect the geolocation of that device in one's possession.

The U.S. patent for XYverify applies carrier cell-tower triangulation with assisted-GPS and other hybrid mobile network technologies—and mobile device micro sensors—to work rapidly throughout indoor locations, where most transactions take place. Previous IP focused on GPS device satellite authentication, but these processes were unable to report accurately indoors. XYverify works in real-time, even on feature phone, to reduce fraud within an approved proximity range to transact.

XYverify keeps specific location information hidden, only reporting a Proximity Estimate match. As a result, financial networks and mobile service providers achieve the verification they need, but not the specific consumer identifying data challenges.

The result: trusted 3rd-party location status verified by out-of-band authentication, combined with variable rules and permissions programmed into the XYverify cloud-based API. Our authentication protection technology can be embedded within mobile phone or tablet device hardware chip or in the firmware that runs underneath various machine operating systems.

When used in combination with a compliant UICC containing a SIM application card, smartphones can connect to mobile provisioning services providing financial institutions a new way to securely receive transaction applications "over the air" to a secure chip on an NFC-equipped smartphone. The connection to mobile provisioning services can be enabled by Trusted Services Management platforms, incorporating cell tower network location verification from XYverify to accept or deny transactions as a way to authenticate.

Click here to learn more about the XYverify technology platform.

Invisible Technology is Different and Better

Invisible Technology is Different and Better

XYverify fraud prevention and compliance verifies your customer's location at time of transaction to reduce risk and fraud. The service applies mobile device location verification as new technology to better authenticate financial services. Working invisibly in the background of transaction, and without any software or code download, XYverify adds breakthrough compliance and risk reduction to better Know Your Customer (KYC) and comply with Anti-money Laundering (AML) regulations. Location intelligence confirms mobile device distance from any business, merchant, home or other postal address locations to better verify or deny transaction requests-never tracking customer location or capturing personal identifiable data into an API solution that confirms real-time customer's mobile device location match to postal mail address distance rules. The privacy-protected approach is unique and dramatically innovates and reduces bank and others risk expense or compliance exposure.

We Deliver 4th Factor Validation Services

XYverify introduces a brand new way for financial institutions to reduce costs around high-risk transactions by allowing them to apply mobile geolocation authentication and do it quickly over mobile in an automated fashion by applying the XYverify API platform in the Cloud.

By incorporating XYverify's 'where are you' data into authentication algorithms that have traditionally relied solely upon a determination of "who are you", those algorithms produce substantially improved results. Subsequently, XYverify's customers realize significantly reduced transaction fraud rates and improved customer service. The XYverify Proximity to Transact verification service works seamlessly in the background as transactions are being undertaken. The service leverages existing wireless infrastructure. No software download or application is required on the associated mobile device.

API Integrates Cloud With Risk Reporting

The API's out-of-band fraud reduction benefits can be combined with geolocation rewards, offers and incentives to generate more revenue for merchants and business partners with robust incentives by using geolocation provided by XYverify API platform that never requires any device application download or install process. Everything works in real-time, even on feature phones to reduce fraud and deliver a new fourth factor of authentication process within an approved geofenced proximity to transact range.

The multi-platform authentication solution can apply to multiple service applications, potentially being the trustworthy verification solution for "intrastate" poker transactions, which means bets are both taken and placed within a given state's borders, such that the subscriber is allowed to make transactional wagers when validated in geofence of his or her pre-registered driver's license home mailing address.

No app install or download required

The U.S. patent applies carrier cell-tower triangulation with assisted-GPS and other hybrid mobile network technologies, and mobile device micro sensors, to work rapidly indoor where most transactions take place. Previous IP focused on GPS device satellite authentication unable to report indoors. XYverify works in real-time, even on feature phone, to reduce fraud within an approved proximity range to transact.

XYverify keeps specific location information hidden only reporting a Proximity Estimate match. As a result, financial networks and mobile services get verification they need, but not specific consumer identifying data. The result is "trusted" 3rd party location status verified by out-of-band authentication, combined with variable rules and permissions programmed into Cloud-based API. The Company applies same technologies for location voting & polling authentication solutions under its eVOTZ® service brand.